Expertise

As the business grows, it becomes increasingly hard to manage cash flow across multiple cost centers, particularly through disparate systems and manual processes that chase media and inventory spending. The potential for human mistakes and processing lags significantly increases when a business expands, resulting in expensive detours and delayed payments.

A Treasury Management System (TMS) centralized cash management, automates dull tasks, and offers visibility into financials.

Let's delve into A TMS, lowering errors and perhaps streamlining global payments into saving some much-wanted time for more strategic business initiatives.

What is a Treasury Management System (TMS)?

Treasury Management Systems (TMS) are often termed as finely-honed finance software solutions for a company's specialized financial operations. A TMS provides the ability to maintain centralized cash flow management, thereby enhancing decision-making capabilities over financial control. It democratizes high-level automation over several key financial processes, hence ensuring improved efficiency along the way.

Automation will save the straining manual work and allow time to focus on more strategic projects for the finance teams. A TMS creates a holistic view of business finance for precise reporting and analyses since it can interoperate with most financial systems, such as ERPs or accounting systems.

What Is The Difference Between an ERP and a TMS?

Both an ERP (Enterprise Resource Planning) System and a TMS (Treasury Management System) are used to take care of the finances of a business; however, they do not provide similar objectives. Functional differences that these two impart can be found in:

- Focus: An ERP is to manage, in a way, almost the whole company for instance accounting, inventory management, human resources among other functions-they get information from anywhere in the organization.

- Data Scope: Generally, an ERP ends up accounting and budget data consolidation, giving a picture of financial transactions, combined with general ledger entries. The TMS does combine other bank and market data to provide avenues for finance teams in a way that they manage their cash, investments, payments, and financial risk.

- Functionality: In comparison, while accounting entries take place in ERPs due to financial transactions, a TMS will produce forecasted treasury entries for the company to predict cash flow needs and plan for future possible financial scenarios.

- Specialization: While ERP finance modules usually have limited functionality for cash management, financial forecasting, or risk management, TMS as a system refers to the specialization of such topics, therefore having features for more complex treasury activities.

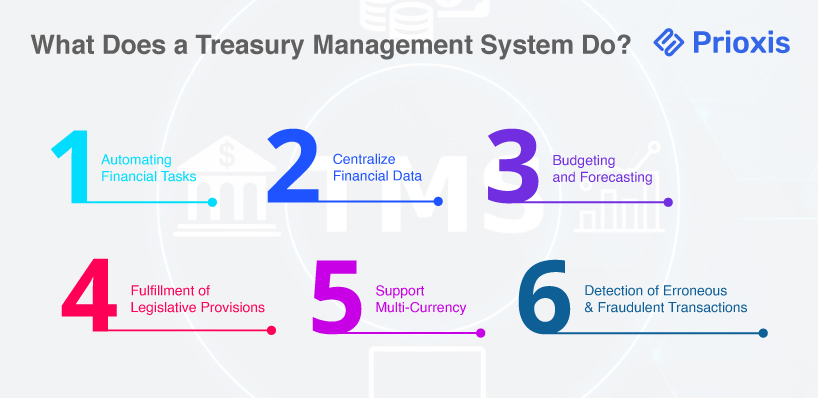

What Does a Treasury Management System Do?

A Treasury management system is software that entails the integration of an organization's activities in managing finances, effectively automated core treasury processes and data centralization while also improving liquidity management to meet the compliance requirements of a regulatory framework. Below are some of the key tasks a TMS could perform:

1. Automating Financial Tasks

Treasury Management System has automated a substantial number of repetitive manual finance processes. It provides a collection of data from ERP systems or spreadsheets, does reconciliation of transactions, and posts transactions to the General Ledger(GL). By automating these functions, a TMS minimizes exposure to human error and maximizes efficiency.

For example, TMS such as cash accounting automatically create GL entries for all bank transactions so that bank transactions are properly reflected in company accounts, and track planned prior-day cash transactions against bank statement items, mark up unmatched items, and deal with matches. Such things save time and improve productivity, with some Treasury Management Solutions touted to have increased productivity by 30 percent.

2. Centralize Financial Data

A TMS collects different sourcing financial data, such as that derived from vendor and Treasury Management Platforms, into a single and unified system. This means access to all imperative financial information in one place, streamlining financial reporting, and then data-driven decision making.

A TMS enhances real-time visibility into the company's financial position, for example, by gathering bank statements, payment information, and transaction histories into one system. It incorporates features like bank statement aggregation to manage the bank statement lifecycle- from opening to closing- and thereby ensures that companies will always be provided with the latest information. Plus, TMS can parse industry-standard bank file formats BAI2 and MT940 to make it easier to input all incoming data from global banking partners.

3. Budgeting and Forecasting

It allows a TMS to provide accurate budgets and cash flow forecasts; it can use learning algorithms along with historical data inputs to predict future cash flows, thus enabling better financial planning. Several predefined templates with various categories and time spans around forecasting models are made available to treasury systems to enable companies to choose the most suitable framework for their needs.

Automated cash forecasting takes into account cash requirements more accurately and allows an organization to adapt its policies to have a good liquidity level. This level of precision in budgeting and forecasting allows an organization to handle its cash position more optimally, understand impending troubles, and make informed decisions based on sound analysis in an offensive strategic sense.

4. Fulfillment of Legislative Provisions

A TMS is also a guarantee that the financial data and report comply with relevant regulatory frameworks such as accounting principles like GAAP (Generally Accepted Accounting Principles). It guarantees that all transactions are formatted accurately as required for internal reporting and audits.

Automated cash management solutions inside TMS generate GL entries for bank transactions by accounting rules. Built-in compliance decreases non-compliance risk and simplifies the process of adhering to financial regulations, giving businesses more confidence that the financial reports are accurate and compliant.

5. Support Multi-Currency

Multi-currency transaction management is the most imperative function of a TMS for companies that operate globally. Such TMSs provide currency conversion rates, track fluctuations, and manage related risks. With a strong TMS system, companies can not only process payments in myriad currencies but also assess exposure, along with accurate accounting of cross-border transactions.

With 75+ global banks, all Treasury Management Solutions are ready to plug-and-play as far as payment format libraries are concerned, making it easy for organizations to add banks and implement effective multi-currency payments across different nations. This is how global businesses streamline their international financial processes while bringing down the complexity of many currencies.

6. Detection of Erroneous and Fraudulent Transactions

An excellent TMS is also equipped with advanced features to detect errors and fraudulent activities in financial transactions. Fraud prevention and error detection are the most important components to protect precious data from fraud and costly mistakes.

Most treasury payment TMS solutions also have anomaly detection capabilities, which can detect up to 90% of errors in payments. Suspicious transactions flagged in real time reduce fraud risk considerably while ensuring that every payment is legitimate. A TMS can keep a watchful eye over every transaction via machine learning algorithms and pattern recognition, safeguarding the cash from possible financial threats.

Business Benefits of Treasury Management Software

The Treasury Management Software (TMS) helps its users gain considerable technical advantages by making financial operations efficient, thus reducing risks and growing efficiency. The following are TMS's key benefits:

1. Financial Operations Efficiency in Real-Time

The TMS allows for continuous cash flow and financial performance visibility in real time, placing decision-making ahead of events. The availability of live data for cash flow forecasting and financial planning ensures that businesses stay in their comfort zone regarding finances.

2. Simplification of Payments Locally and Globally

A TMS makes local and cross-border payments easier by managing multicurrency accounts and allowing the use of business cards worldwide for making payments. Such initiations reduce the complexity and the cost of transactions worldwide, which maximizes the payments' efficiency.

3. Rapid Invoice and Receipt Handling

Automating portions of the accounts payable process, including receipt matching and payment scheduling, speeds up invoice processing. This ensures payments are made on time and discrepancies are caught early, saving time and being very cost-effective.

4. Reduced Risk to Finances

By automating financial tasks, errors caused by human intervention would be reduced; thus, enhanced risk management will be feasible, too. Built-in fraud detection and compliance checks ensure flexible risk mitigation and compliance with regulations.

5. Financial Processes That Scale

The TMS standardizes processes that adapt to growth within the organization. As the company grows, the finance teams will be spending their valuable time on the things that genuinely matter, like controlling cash flow and identifying areas where costs can be cut, instead of using their manpower on administrative functions.

6. Better Cash Flow Management

A TMS enables superior management of cash flow because it provides real-time data and automated processes. Cash management for the accounts receivable department is enhanced as it integrates with other financial systems.

7. Enhanced Efficiency

Efficiency is enhanced by TMS in manual work processes, such as data entry and reconciliation. Employees are free to work on value-added tasks, with finance being more efficient and timely.

8. Reduction in Costs

A TMS gives visibility into transaction costs, allowing organizations to minimize unnecessary payments. It further minimizes administrative costs through the automation of manual processes.

9. Better Cash Visibility and Cash Forecasting

A TMS helps firms obtain more command over cash flow and produce accurate cash forecasting, conserving the working capital. Real-time visibility drives better financial planning.

10. Better Fraud Protection

Fraud protection tools embedded within the system will identify anomalies in transactions, limiting the scope of any fraudulent activity. This is supported by real-time monitoring of suspicious activities so that the financial information under risk is protected.

How Does a TMS Work?

A Treasury Management System (TMS): a complete solution that is aimed at automating and streamlining financial processes so that businesses can be in better control of their cash, liquidity, and financial risks.

A TMS works through the collection from several sources: bank accounts, payment systems, and investment portfolios—giving treasurers a comprehensive and precise view of the cash position of a company. With centralized data available for analysis, treasury officials are more informed about making decisions involving cash management, investments, and resource allocation, giving the firm the ability to prevent cash flow shortages and cut down on borrowing costs.

The system further consists of several modules, each dedicated to different aspects of financial management:

- Cash Management: The TMS codes funds available when either incoming or outgoing transactions have been processed via ACH transfers. It tracks receivables, payables, and bank activity for optimal cash flow.

- Cash Forecasting: The TMS uses historical data and trend analysis to assist in accurately forecasting future cash needs so that treasury teams can adjust budgets and plans to avert any unexpected costs.

- Risk Management: A TMS provides tools to help identify, assess, and manage financial risks such as foreign exchange, interest rate, and credit risks. By actively tracking these risks in real time, firms can take preemptive measures to counter possible financial threats.

- Liquidity Management: The TMS ensures that there is continuous cash flow tracking so that organizations can plan for immediate cash outflows (such as payroll and vendor payments) and, thus, avoid overdraft fees and unnecessary borrowing.

Conclusion

In conclusion, a Treasury Management System (TMS) may centralize and automate financial processes while offering real-time information on cash flow and risk management. TMS fosters better decision-making, cash forecasting, and prevention of errors and fraud. A TMS can help a company with cash management, forecasting, and liquidity monitoring of financials for scaling operations and payment streamlining. Overall, the benefits of a TMS lie in the enhanced efficiency, cost-cutting, and financial control, which are important in treasury operations improvement.

01Why do you need a treasury management system?

A Treasury Management System is very important for an enterprise in making the financial activities work easier, managing cash flow better, and minimizing risks. It automates all manual transactions while providing real-time visibility on cash position, forecasts, and future risks, thus aiding decision-making.