Expertise

In this highly competitive and fast-paced world of business, organizations feel the need to utilize different strategies to cut down on costs, render operations efficient, and stay ahead of the competition. Old-fashioned accounts payable (AP) processes work under paper invoices, manual entry, and prolonged approval cycles, which could not be sustained anymore by the organizations. These days, businesses require smarter, quicker, and more precise financial management solutions.

This is where AP automation comes in. AP automation using advanced AI-based technology works in reducing errors, increasing visibility into finances, and eliminating time-consuming manual processes.

In this blog, we'll explain what AP automation is all about, how it works, and why it's essential for today's businesses. Continue reading to learn how AP automation can transform your AI accounts payable procedure.

What Is Accounts Payable(AP) Automation?

Accounts Payable (AP) automation is a technology to automate and digitalize AP processes. This minimizes manual touch and human errors. It automates major activities like receipt of invoices, coding, approval routing, payments, and reconciliation for more precise financial processes.

AP automation reduces data entry while increasing efficiency. With embedded dashboards and analytics, companies can track workflows in real time, identify differences, and achieve greater financial control. By implementing AP automation, organizations can streamline cash flow, improve supplier relationships, and increase operational skills.

Challenges with Manual Accounts Payable

Manual accounts payable automation management brings in inefficiencies, errors, and financial risks. Below are the major challenges and how automation benefits businesses:

- Human Errors in Data Entry

Inaccurate and manual processing produces errors like duplicate, underpaid, or overpaid invoices that create financial variances. AP automation reduces errors with AI-enabled data entry and validation features.

- Inefficient Document Management

Manual storage of invoices and financial documents complicates retrieval and raises compliance risks. Automated AP solutions enable centralized, searchable, and easily accessible document storage.

- Delayed Approval Processing

Manual approval workflows are time-consuming, leading to delayed payment and vendor relationship stress. Automation enables faster invoice routing and approvals, improving cash flow and vendor confidence.

- Increased Fraud Risk

Manual AP processes are prone to fraudulent transactions without supervision. Automation integrates tools for fraud detection, marking unusual activity, and improving security.

- Lack of Real-Time Visibility

Paper-based Accounts Payable Automation Systems are not capable of real-time tracking of invoices and payments. Automation offers real-time dashboards and analytics, improving transparency and decision-making.

- Poor Cash Flow Management

Delayed payments and slow processing can contribute to ineffective working capital management. AP automation streamlines payment cycles, lowering DPO and enhancing financial stability.

- Duplicate Payments

Manual processes usually lead to duplicate payments and invoices, raising costs and workload. Automated AP systems identify and block duplicates, promoting accuracy in financial transactions.

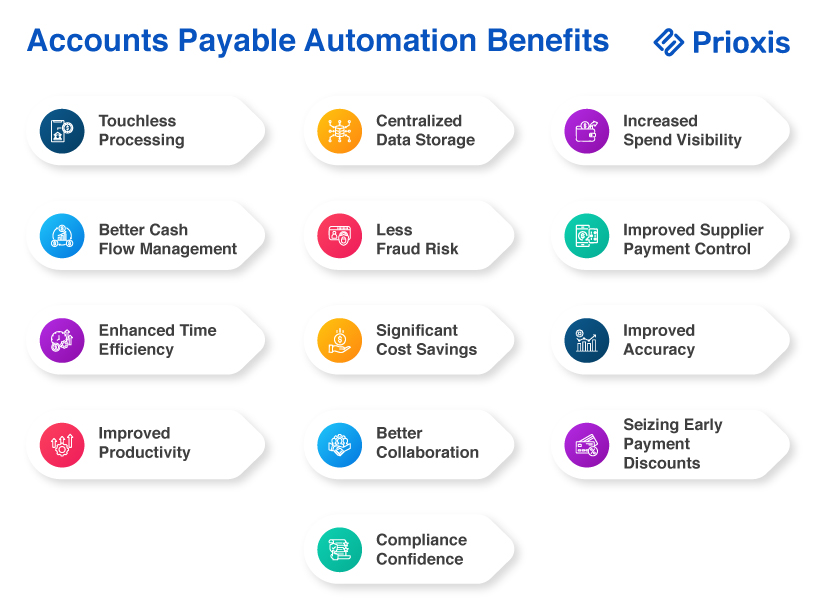

Accounts Payable(AP) Automation Benefits

Automated Account Payable integrates financial processes, improves efficiency and lowers expenses. The major advantages of AP automation are discussed below:

- Touchless Processing

Eliminates the need for manual data entry, decreasing errors and enabling workers to concentrate on strategic initiatives.

- Centralized Data Storage

Electronic data capture and storage of all AP information in a searchable system, making access, auditing, and compliance simpler.

- Increased Spend Visibility

Facilitates real-time visibility into spending, helping track budgets better and plan finances.

- Better Cash Flow Management

Ensures on-time payments and maximizes cash usage, resulting in improved financial management.

- Less Fraud Risk

Comes equipped with fraud prevention features to eliminate duplicate payments and detect suspicious behavior.

- Improved Supplier Payment Control

Enables companies to personalize payment timing, enhancing supplier relations and productivity.

- Enhanced Time Efficiency

Eliminates manual processing, saving time and enabling employees to focus on value-added activities.

- Significant Cost Savings

Less labor, storage, and postage costs by eliminating manual paperwork.

- Improved Accuracy

Eliminates human errors, offering precise financial data and quality decision-making.

- Improved Productivity

Supports AP teams to process large volumes of invoices quickly, minimizing Days Payable Outstanding (DPO).

- Better Collaboration

Offers visibility into AP data in various locations, enhancing collaboration and decision-making.

- Seizing Early Payment Discounts

Supports companies in availing supplier discounts, enhancing financial effectiveness.

- Compliance Confidence

Automates tracking and reporting, assuring compliance with financial regulations and audit readiness.

Which Accounts Payable Tasks Can Be Automated?

Accounts payables automation simplifies different processes, minimizing errors and enhancing efficiency. Every business has its processes, but these are the primary AP tasks that can be automated:

- Data Entry and Invoice Capture

Artificial intelligence-based OCR technology rapidly extracts and digitizes invoice information, preventing manual input errors.

- Invoice Matching and Validation

Automated systems match invoices against purchase orders and receipts to ensure accuracy before paying.

- Approval Routing and Workflows

Pre-established approval rules guarantee invoices are sent to the appropriate individuals for authorization, ensuring security and compliance.

- Payment Scheduling and Execution

Automation schedules and makes payments according to due dates and cash flow strategies, maximizing financial resources.

Explore More: What is a Treasury Management System?

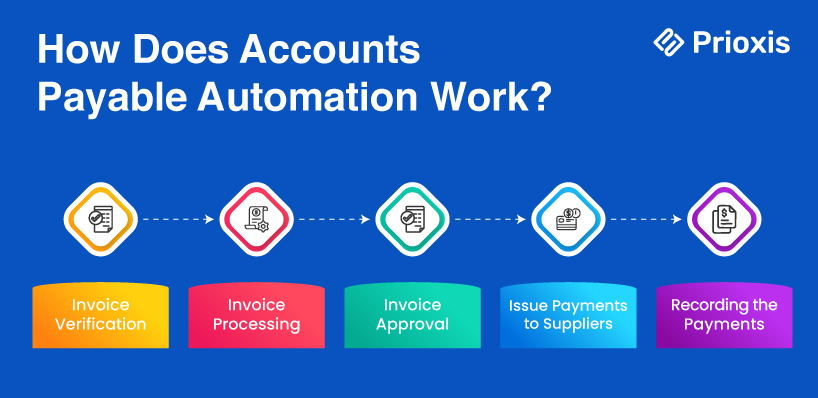

How Does Accounts Payable Automation Work?

Automation of Accounts Payable Automation Process automates the whole AP process through financial system integration and reduces manual labor. This is how it is done:

- Invoice Receipt

Invoices are received electronically or scanned by Optical Character Recognition (OCR) technology.

- Data Extraction

The system automatically captures and inputs pertinent invoice data into the AP system, eliminating manual entry errors.

- Coding and Approval

Invoices are coded according to company policy and channeled to the right approvers for speedy authorization.

- Payment Processing

Approved invoices are set for electronic payments to promote timely payments and better cash flow management.

- Reconciliation

Payment data is matched against invoices and purchase orders to check for accuracy and completeness, keeping discrepancies to a minimum.

How to Automate Accounts Payable Process?

Accounting for AI in accounts payable automation requires planning and strategy. Here are the important steps to follow for a seamless switch:

- Assess Existing AP Processes

Determine inefficiencies within your existing workflows to assess what areas would see the most value from automation.

- Select the Appropriate AP Automation Software

Select a solution that integrates seamlessly with your accounting systems, scales, and fits your business needs.

- Deploy Digital Invoice Capture

Digitize invoices through OCR and e-invoicing technologies, eliminating manual data entry and errors.

- Set up automated workflows

Design approval hierarchies and routing rules to facilitate streamlined invoice processing, reduce delays, and enhance compliance.

- Create a communication and training strategy

Train teams on the advantages of automation, gather feedback and facilitate a smooth transition without affecting operations.

Conclusion

There's a complete game-changer in payables automation for the company to economize on cutting the financial processes to be efficient and more stress-free of errors. AP Automation will save companies time while performing tedious data entry, speed up approvals, and streamline cash flow-one line- above all, it will greatly improve financial control and security.

Cost savings, draining fraud risk, and enhanced supplier relationships come to an adopted automation strategy. Proper strategy and relevant solutions can enable organizations to change their AP processes into simple systems without errors that will take them into fruitful long-term continuity. It's time to get the manual processes straightened out and start working towards an automated, bright, streamlined financial future.