Table of Content

AI and analytics have become must-haves in today’s Big Data in insurance industry. While you're reading this, digital-native insurers are processing claims 50% faster, detecting fraud 40% more accurately, and capturing market share from traditional players who are still deliberating their Big Data and insurance strategy. Customers expect fast, personalized service, and to deliver that, insurers need a smart mix of human expertise and Big Data analytics in insurance technology. This combination makes operations smoother, sparks new ideas, and ensures clients get the quality and attention they expect, driving growth and loyalty.

The numbers tell a brutal truth: According to McKinsey's latest insurance report, 60% of traditional insurers are already losing premium revenue to data-driven competitors. These aren't just small losses – we're talking about a 15% market share erosion in the past 24 months alone. The message is clear: adapt or become irrelevant.

According to McKinsey's Insurance 2030 report, the insurance industry stands to gain up to $370 billion in value through AI and advanced analytics implementations by 2025.

The old ways of doing business – annual reviews, standardized policies, reactive claims processing are dying. Today's insurance leaders are using Big Data to predict claims before they happen, price risks with precision, and deliver personalized coverage in real-time.

Big Data and insurance tech is making big changes in insurance industry, helping companies understand their customers better, support insurance advisors in making quick decisions, and improve everyday tasks.

Insurance companies use data from accidents, past claims, customer profiles, and other sources to understand each person’s risk level. This helps them offer the right plans, prevent fraud, and control costs, leading to fair prices and tailored services.

Big Data analytics doesn’t only work for analyzing customers data, it’s also a valuable tool for insurance advisors. With insights into what customers prefer and how they behave, advisors can recommend the right coverage options, personalize it by spotting chances to add more value, and manage their daily tasks more smoothly. This means advisors can focus on real solutions that fit each customer’s needs, leading to better results and stronger client relationships.

Fraud is a major concern in insurance, and Big Data Analytics in Insurance helps businesses to fight it. Every day, data analysis flags hundreds of fake claims by finding unusual patterns and checking social data, helping insurance companies reduce losses and keep premiums fair. In fact, insurance fraud costs the industry over $80 billion annually, adding $400–$700 to the average U.S. family’s premiums.

Big Data also makes the claims process smoother. By using real-time data, insurers can speed up claims handling, meaning shorter wait times and happier customers. Routine processes get automated, so staff can focus on complex cases and overall efficiency.

As Paul Ford, CEO of Traffk, puts it, “Insurance companies have a lot of data. Our goal is to use this data to create new and innovative insurance products.” Big Data allows companies to design plans that better meet customer needs, giving them a strong advantage.

Every day, vast amounts of data are generated on social media and online platforms, providing a rich source of insights into customer behaviors and preferences. With insights drawn from vast amounts of unstructured data such as social media behavior and online activity patterns. Insurers can build targeted, data-backed campaigns that are relevant to specific customer needs and motivations. This data-driven approach leads to faster lead conversions and more efficient outreach, far surpassing traditional survey methods.

AI and big data are transforming claims processing. Insurers use algorithms to automate insurance claims intake, extract essential data from documents, and speed up case handling. For example, AI can assess car damage from images, enabling faster and more accurate claim decisions. This tech-first approach helps insurer companies meet customer expectations with advanced, responsive service.

Customer retention acts as a cash cow in maintaining profitability, especially when a small percentage of clients contribute significantly to revenue. Big data analytics allows insurers to pinpoint the factors impacting customer loyalty, helping you proactively resolve issues that might otherwise drive clients away. With a predictive understanding of customer behaviors and acting on these insights can greatly improve customer satisfaction and retention.

As you know, risk is at the front of any insurance business. Big data transforms traditional risk assessment by helping insurers to analyze granular lifestyle, health, and behavior data, allowing for more precise risk segmentation. By leveraging these insights, underwriters can differentiate risk profiles—for example, distinguishing between an active individual and one with a high-risk lifestyle. This precision in risk assessment allows for more accurate premium pricing and smarter underwriting decisions

Prioxis developed a high-performance, cloud-native application for Trulife Financial, strategically leveraging big data for client management and actionable insights. Built with a microservices architecture using .NET Core for backend stability and Angular for a responsive interface, this platform, hosted on Microsoft Azure, is designed for scalability, GDPR compliance, and advanced analytics. Big data enables the platform to process high volumes of client information, delivering real-time insights and secure management tools. Trulife benefits from integrated admin portals and intelligent dashboards, streamlining workflows and supporting data-driven decisions for both advisors and managers. This solution showcases big data’s transformative role in enhancing operational efficiency and precision in financial services.

Insurance fraud costs the industry billions each year, but big data analytics can provide an effective line of defense. By analyzing patterns and comparing them against historical fraud data, big data tools can identify potentially fraudulent claims early in the process using Predictive analytics allowing for targeted investigations. This data-backed fraud prevention improves claim integrity, minimizes losses, improves overall trust in your services while maintaining overall financial health.

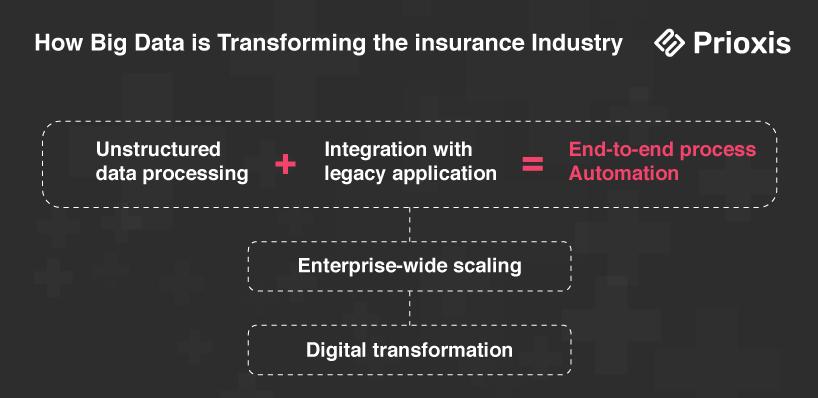

Automation, powered by big data, is rapidly becoming essential for operational efficiency. By automating resource-intensive processes like claims handling and customer support, big data helps insurers cut down on time and costs, freeing up teams to focus on higher-value tasks. The result is a streamlined operation with reduced overhead, improved processing speeds, and cost-effective service delivery.

Customers today expect personalized service, and big data makes it possible. Big data allows insurers to create dynamic, customized policies and pricing models that align with individual client profiles, enhancing satisfaction and retention. This personalized approach not only meets client expectations but also positions your brand as a forward-thinking leader in customer-centric service.

Big data tools simplify internal processes, improving accuracy and reducing manual work by up to 80% through automation. With streamlined operations and data-driven workflows, insurers can improve service quality and reduce errors, leading to faster claim resolutions and more effective team performance.

Customer lifetime value (CLV) helps insurers understand how much a customer might be worth over their entire relationship with the company, based on the revenue they’re likely to bring in compared to costs. Insurers use data on customer behavior to predict this value, guiding them in making smarter pricing and policy decisions. Advanced analytics consider factors like “recency” (how recently a customer interacted) and “frequency” (how often they engage) to project future earnings. These algorithms combine data points to predict actions like whether a customer will keep or drop a policy. CLV predictions also provide valuable insights for shaping marketing strategies by understanding customer habits.

Data science supports insurers in developing tailored products that better match customer needs. Recommendation algorithms identify customer preferences from account activity and recommend relevant products, improving the chances of successful upselling and cross-selling. This helps insurers align offerings with individual customer interests, increasing overall customer satisfaction and revenue.

Connected cars transform auto coverage as cars now track how we drive through built-in sensors. Insurance companies use this data to offer fair rates - careful drivers pay less, while risky drivers pay more. Leveraging data from GPS and sensors in vehicles allows insurers to offer usage-based insurance policies, providing discounts for safe driving behavior and reducing premiums for low-risk drivers.

Health insurers can use data from wearable devices to offer personalized health policies, rewarding customers who adopt healthy habits and reducing potential claim risks. When you stay active, eat well, and get enough sleep, insurers analytics see you're taking care of yourself. This often leads to lower premiums since healthy people typically need less medical care.

By collecting data from smart home devices (like smoke detectors or water leak sensors), insurers can mitigate risks and offer discounts for policyholders who invest in home security technologies.

This technology-driven approach helps both sides: consumers save money for responsible behavior, while insurance companies face fewer claims.

Big data brings clarity, precision and digital transformation to the insurance industry. By analyzing data from every customer interaction, insurers can better understand client needs, streamline claims, and make accurate pricing decisions. Imagine knowing which clients are likely to renew, identifying fraud early, and setting prices based on solid data instead of guesswork.

Insurers who adopt big data analytics are seeing real improvements: faster claims, reduced underwriting costs, and stronger client retention. For CEOs and CTOs, using data effectively is about bringing real, measurable value to your operations and customer relationships.

Prioxis offers the tools and insights to help you make informed, data-based decisions. Contact us to discuss how big data can enhance your insurance processes and client satisfaction.

Get in touch