Expertise

You can automate 27 percent of your business's finance activities. How? Through Robotic process automation (RPA). But what's RPA? No, it's not something from a sci-fi movie like Star Wars. But it is far more practical and immediate. RPA is a technology that uses software “robots” or bots to automate repetitive, rule-based tasks.

RPA mimics human interactions with digital systems. It enables bots to execute repetitive tasks across various applications without human intervention. It is so powerful that a basic RPA program alone can enable an organization to address 12 to 18 percent of general and administrative tasks. But how can this disrupt the finance sector, and which task can you automate using RPA? These blogs uncover answers to all these questions.

In this detailed guide, you will discover;

- What is RPA in Finance

- Why RPA in Finance

- How is RPA Used in Finance

- See RPA in Action: Real Finance Examples

- What Are the Real Benefits of RPA in Finance?

- How to Get Started with RPA

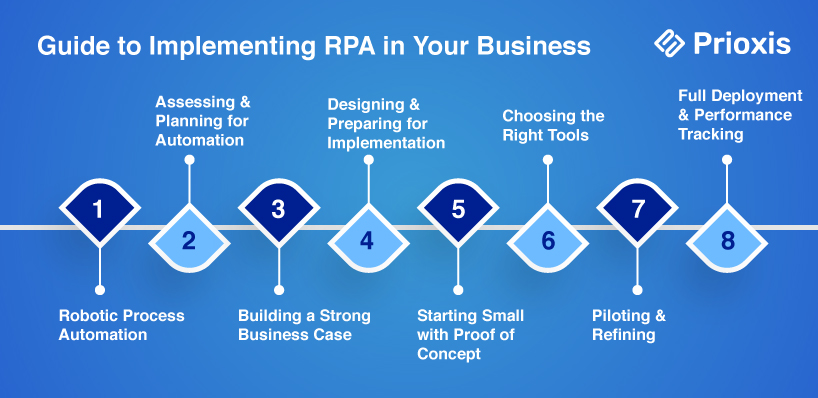

- Guide to Implementing RPA in Your Business

- Common RPA Challenges and How to Solve Them

- How to Know If Your RPA Implementation Is a Success

RPA in Finance: Meaning

RPA uses software bots in finance to replicate human actions, automating routine tasks. These tasks include data entry, invoice processing, accounts reconciliation, report generation, and more.

The Need for RPA in Finance

80% of financial firms have already adopted or plan to adopt RPA. Financial organizations can save time and cost and improve their efficiency through RPA.

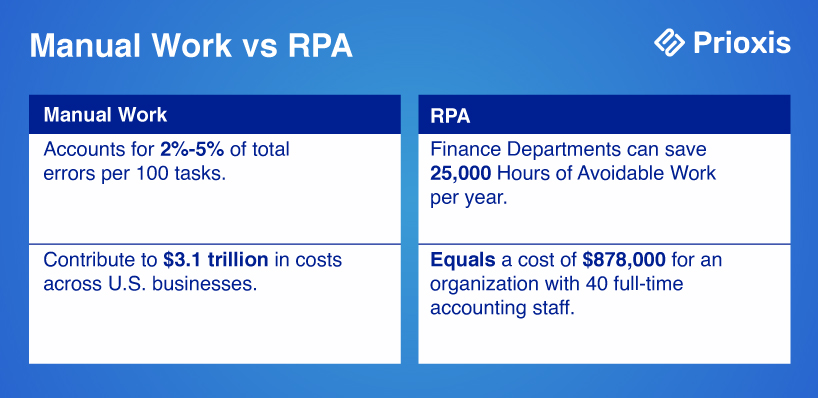

One reason is the risk of error due to manual work in finance and accounting. Human errors contribute to $3.1 trillion in costs across U.S. businesses. However, with RPA, finance departments can save 25,000 hours of avoidable work per year. This equals a cost of $878,000 for an organization with 40 full-time accounting staff.

Plus, many departments overspend on labor. Infact, labor makes 60% of total Accounts Payable costs, according to the American Productivity & Quality Center.

RPA Use Cases in Finance

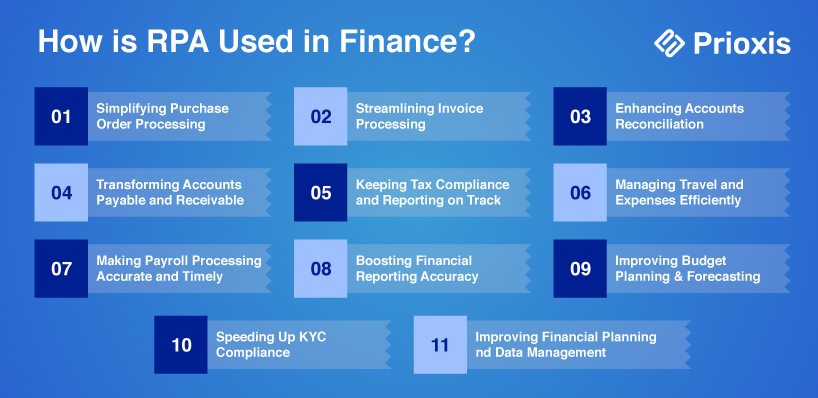

Simplify Purchase Order Processing

Handling purchase orders manually is repetitive, exhausting, and prone to missteps. Especially in Fintech, where cash inflows and outflows are constant. Thus, creating, sending, and getting approval for purchase orders can become monotonous. However, with RPA integrated with AI, this process becomes a simple task.

The bots cut the possibility of errors, capture data, and automate the approval process. It’s simple, effective, quick, and, best of all, cost-saving.

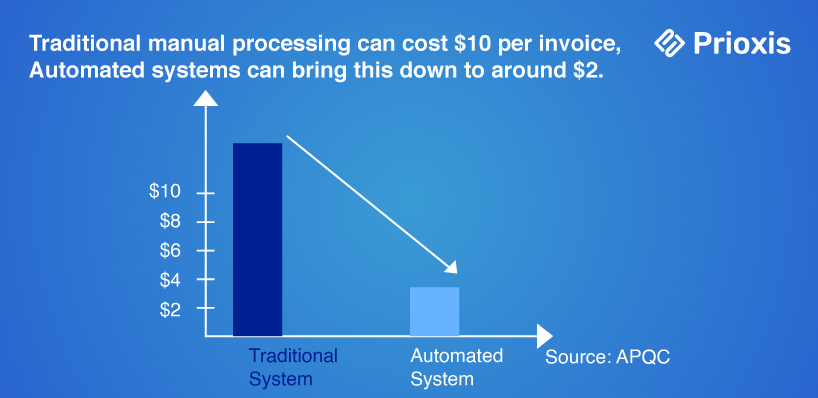

Make Invoice Processing a Snap

Invoice processing can feel like a never-ending chore. Especially when dealing with different formats and client-specific requirements. Financial organizations often need help to get invoices right the first time, leading to delays and rework.

RPA is an efficient way to pay bills. It ensures accuracy and speeds up approvals. Plus, when you integrate automated invoicing software with RPA, you can cut the maker-and-checker process. As the system matches invoices with relevant purchase orders seamlessly.

Streamline Accounts Reconciliation

Accounts reconciliation is one of those tasks that can take hours and leave room for errors. It’s critical yet tedious, especially when dealing with many systems. It becomes more time-consuming when dealing with sub-companies with different accounting structures. RPA in Finance and Accounting can make this easier for you.

RPA bots can log into various systems, audit, and reconcile data at every step with minimal human intervention. The bots ensure that everything is quick, consistent, and correct. It will only flag when something important needs your attention.

Transform Accounts Payable (AP) and Accounts Receivable (AR)

Managing accounts payable and receivable is like juggling—there are many moving parts, and if you drop one, the consequences can be severe. RPA bots can take over most of these tasks.

This includes generating invoices, matching them to purchase orders, routing for approvals, and processing payments. Whether it’s outgoing documents or incoming ones, RPA handles it efficiently. Thus, reducing errors and speeding up the process.

Keep Tax Compliance and Reporting on Point

Tax season doesn’t have to be stressful anymore. With RPA in Finance and Accounting, you can automate data collection for tax reporting, calculate tax liabilities, and even submit tax returns.

This automation minimizes the risk of errors and ensures you meet all compliance requirements on time. RPA allows your finance team to focus on strategic tax planning rather than getting bogged down by repetitive, manual tasks.

Manage Travel & Expenses with Ease

Tracking and approving travel expenses can be a real headache. It can often delay reimbursements and cause frustration. However, with RPA in Finance and Accounting, creating and processing expense reports is straightforward and fast.

RPA compares given data against company policies. It informs your accounting team whether the expenses comply. This not only speeds up the reimbursement process but also ensures accuracy and adherence to company guidelines.

The bots ensure all records follow company policies and even send automated alerts for discrepancies. This makes the entire travel and expense management process smoother, faster, and less prone to errors.

Make Payroll Processing Less Time-consuming

Payroll is one area where mistakes are not an option. Studies show that approximately 20% of payrolls have errors. Each of these payroll mistakes cost organizations $291 on average.

With RPA, you can avoid this. It can calculate wages, handle deductions, or ensure compliance with tax regulations.

The result? Timely and correct payroll processing. This leads to happier employees and a smoother operation. RPA can manage these tedious tasks for hours on end without getting tired or making errors. Thus, making it an essential tool for any large financial institution.

Boost Financial Reporting Accuracy

Financial reporting involves gathering data from various sources, confirming it, and generating reports. When done manually, these tasks are time-consuming and prone to errors. RPA changes the game by automating this entire process, allowing for faster, more accurate report generation.

This means your financial insights are more reliable. Thus, RPA enables better decision-making and strategic planning.

Enhance Budget Planning & Forecasting

Accurate budget planning and forecasting are crucial for any business but need lots of data gathering and analysis.

RPA can automate these tasks. It ensures you have detailed variance reports and accurate forecasts at your fingertips. RPA combines historical data with current information and allows for accurate comparisons and trend analysis. It enables better decision-making and improving your financial management processes.

Speed Up KYC Compliance

The average financial firm spends $52 million per year on KYC compliance. For some banks, it can be up to $384 million on KYC compliance and Customer Due Diligence (CDD).

That's huge. Know Your Customer (KYC) compliance is necessary but time-consuming.

RPA can streamline KYC by automating the collection and verification of customer information. This not only reduces the time and resources needed but also minimizes costly errors. Faster KYC processes mean quicker customer onboarding and an improved experience.

Improve Financial Planning and Data Management

When it comes to financial planning, you need accurate data and insightful analysis.

RPA can gather, format, and add data from various systems. This allows for better forecasting and more informed decision-making. By automating these tasks, RPA ensures that your financial planning processes are faster and more reliable. Thus, with RPA, you get a clear view of your company’s financial health.

Read Further: RPA Use Cases for Industries

See RPA in Action: Real Finance Examples

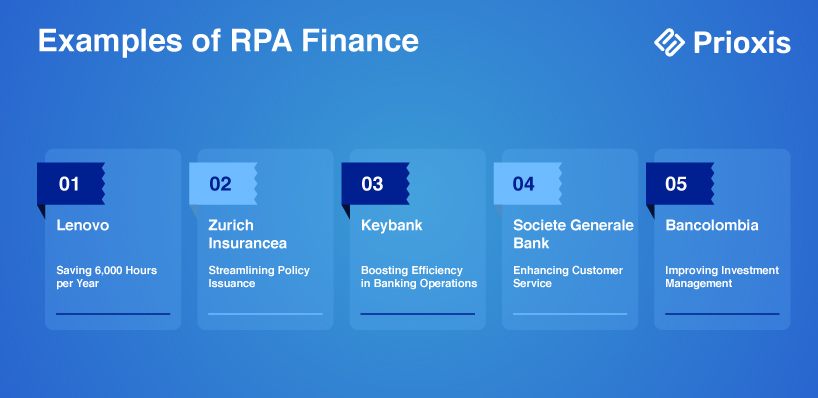

Lenovo – Saving 6,000 Hours per year

Lenovo aimed to streamline its payroll processes as part of its digital transformation. The challenge involved managing a complex network of systems like SAP, Workday, and People Soft. These in the past required many manual tasks.

To address this, Lenovo implemented RPA bots in various workflows. This included tax processing, expense reimbursement, payroll scheduling, and employee self-service. This automation has saved Lenovo's HR team 6,000 hours each year and improved process efficiency by 5 to 8 times.

Zurich Insurance Streamlines Policy Issuance

A global insurance leader, Zurich introduced RPA to automate its policy issuance process. Using RPA enabled Zurich's team to handle daily tasks and manage standard policies more efficiently.

This automation allowed Zurich to concentrate on more complex insurance matters while ensuring consistency in routine work.

Keybank Boosts Efficiency in Banking Operations

Keybank is a prominent commercial bank. They adopted RPA early to boost efficiency and accuracy in their banking operations.

They used RPA for tasks like invoice management, purchase orders, bill processing, and payment methods. After implementing RPA, these processes were smoother and error-free.

Societe Generale Bank Enhances Customer Service

Societe Generale Bank is a key player in financial services. They implemented RPA to handle repetitive and time-consuming tasks.

The deployment of RPA bots improved customer service and helped transform their business model.

Bancolombia Improves Investment Management with RPA

Bancolombia, Colombia's largest bank, implemented RPA to help clients in managing their investment portfolios.

Their RPA tool, "Invesbot," provides real-time market insights and portfolio performance updates. It also advises on necessary adjustments based on current conditions.

Additionally, Bancolombia developed a robo-advisor to guide Colombian investors in the stock market.

What Are the Key Benefits of RPA in Finance?

Let's now discuss benefits of employing RPA.

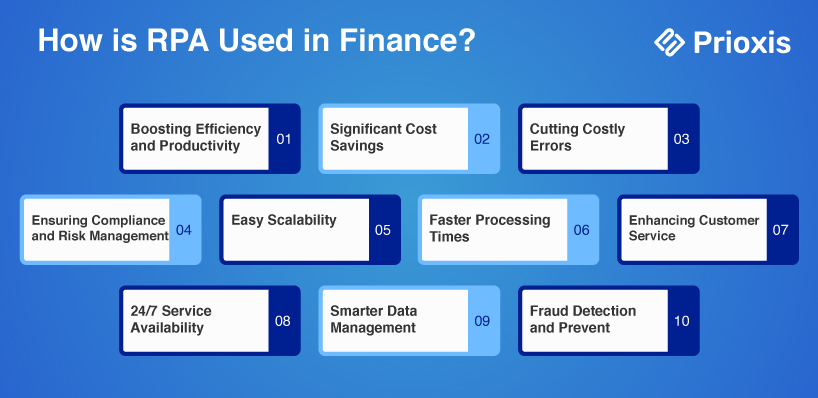

1. A Quick Boost to Efficiency and Productivity

RPA takes over repetitive, mundane tasks. Financial institutions can use RPA to complete processes faster and with fewer mistakes. By automating tasks like data entry, invoice processing, and account reconciliation, RPA frees up time for staff. Thus, they can focus on more strategic, value-added roles.

2.Save Big with RPA

By cutting down on manual labor and reducing operational expenses, RPA in Finance and Accounting can save financial organizations between 25% to 50%. Automation cuts redundancies and streamlines processes, leading to noticeable cost reductions.

3. No More Costly Mistake

RPA minimizes human errors in data handling. It processes large volumes of transactions with high precision. It also ensures that financial data stays correct and reliable.

This is especially important in accounts payable and receivable areas, where errors can be costly.

4. Stay Compliant and Manage Risks Better

RPA helps financial institutions follow regulatory requirements by keeping detailed records and automating reporting. This ensures adherence to strict standards and reduces the risk of penalties for non-compliance.

5. Scaling Made Simple

RPA systems can scale to handle increased workloads during peak times without extra staff. This scalability allows financial institutions to adapt fast to market changes and customer needs.

6. Faster Processing Times

RPA boosts the Processes like loan approvals and customer onboarding. For example, loan processing times can shrink from weeks to minutes by automating data extraction and verification tasks.

7. Better Customer Service

RPA enhances customer experience by automating routine inquiries and transactions. This leads to faster response times and more correct information. Thus, resulting in higher customer satisfaction.

8. Round-the-Clock Service

RPA systems work around the clock without breaks. With RPA, financial institutions can provide services at any time. This continuous availability improves service delivery and meets customer needs promptly.

9. Manage Your Data Smarter

RPA standardizes data entry and documentation, improving data quality and accessibility. This is crucial for effective financial analysis and decision-making.

10. Spot and Stop Fraud

RPA strengthens security by monitoring transactions in real-time for any signs of fraud. Automated systems can flag suspicious activities, allowing for immediate intervention.

How to Get Started with RPA

To begin your RPA journey, use these simple techniques:

Design Thinking

Focus on the people involved and their experiences. Consider the entire process from start to finish, keeping human needs and data in mind. This helps you create solutions that work well for everyone.

Start from Scratch

Instead of trying to fix old processes, design a new one from the ground up. This allows you to create a more efficient and streamlined process without being limited by what’s currently in place.

Assess Roles

Look at the different roles in your company to see which tasks can be automated. This will help you decide where automation can make the most significant difference.

Test the Basics First

Develop a simple version of your new process and test it in small, quick steps. Release updates every few months to see how it performs in real situations and make improvements as needed.

A Simple Guide to Deploying RPA in Finance

1.Start with Clear Goals

Begin by defining what you want to achieve with RPA. For instance, cutting costs, improving accuracy, or boosting efficiency.

Find the finance processes that will benefit most from automation. Make sure they align with your business goals.

Take a close look at your workflows to confirm that RPA can deliver real, measurable improvements.

2. Assess and Plan for Automation

Review your current processes to find routine, rule-based tasks that are good candidates for automation.

Consider each task's complexity, transaction volume, and impact.

Focus on tasks that offer the highest potential return on investment (ROI) to ensure you get the most out of your efforts.

3. Build a Strong Business Case

Outline the benefits you expect from RPA. For instance, save money, increase productivity, and improve accuracy.

Prepare a detailed ROI analysis to show the financial value of the RPA project.

Find potential challenges and risks and plan how to manage them.

4. Design and Prepare for Implementation

Create a clear implementation plan that includes timelines, resources, and risk management.

- Design automation workflows that will integrate well with your existing systems.

- Predict potential challenges in integrating RPA and plan how to address them.

- Ensure your plan covers all aspects of deployment for a smooth rollout.

5. Start Small with Proof of Concept

- Begin with a small, practical application, like a basic bot, to test the feasibility of RPA within a few weeks.

- This early project will give you hands-on experience and help you build excitement for the larger RPA program.

6. Choose the Right Tools

- Select technologies that balance simplicity with effectiveness.

- Start with a primary RPA platform. Then, complementary tools like process management or data recognition systems

- Introduce more advanced tools as your program grows

7. Pilot and Refine

- Test the RPA system on a small scale to find and fix any issues.

- Gather feedback from stakeholders and refine the processes.

- Ensure the pilot is successful before rolling out RPA on a larger scale.

8. Deploy and Track

- Roll out RPA across your finance department, ensuring smooth integration with existing systems.

- Track the RPA system's performance and adjust it to keep it running efficiently.

Common RPA Challenges and How to Solve Them

Integration with Current Systems

RPA needs to work with existing software. But many organizations struggle with compatibility issues because of different technologies and protocols.

Solution: Create a clear integration plan that outlines how RPA will connect with your existing systems. Find critical areas for integration. Test to ensure everything works together smoothly.

Scaling the System

As businesses grow, RPA systems may need help to keep up with increased workloads, causing performance issues.

Solution: Plan for scalability right from the beginning. Use load balancing and track performance to tackle any bottlenecks before they affect operations.

Shortage of Skilled Personnel

Finding experienced RPA professionals can be difficult. This makes it hard to install and maintain the system.

Solution: Consider working with RPA service providers. They have an experienced team of RPA experts ensuring your project's success. Outsourcing RPA solutions to countries like India can also reduce costs.

Ongoing Maintenance and Updates

RPA systems need regular maintenance, including updates and patches. Ignoring this can lead to errors and downtime.

Solution: Set up a maintenance schedule that includes regular updates and monitoring. Consulting with RPA experts can help keep your system running smoothly and securely.

Managing Change

Employees might resist adopting RPA. Because they fear for their job security or lack understanding of how the technology benefits them.

Solution: Communicate the benefits of RPA and involve employees in the process. Regular training sessions help ease concerns and build acceptance.

Choosing the Right Processes to Automate

Not every process is suitable for automation, and picking the wrong ones can lead to project failure.

Solution: Analyze your processes to find the best candidates for automation. Focus on repetitive, high-volume tasks and avoid complex ones.

Managing Costs and ROI Expectations

Organizations often need to pay more attention to the costs of implementing RPA. This can lead to budget issues and unmet return on investment (ROI) expectations.

Solution: Conduct a thorough cost-benefit analysis before starting your RPA project. Consider both the first costs and long-term expenses like maintenance and operations.

Ensuring Infrastructure Stability

A robust IT infrastructure is key to a successful RPA deployment, but outdated hardware or software can cause problems.

Solution: Review and upgrade your current infrastructure to ensure it can handle RPA workloads. Regular monitoring can help spot and fix issues before they become significant problems.

Security Concerns

RPA systems can be vulnerable to cybersecurity threats if they’re not properly protected.

Solution: Install strong security measures, such as encryption and access controls.

How to Measure the Success of Your RPA Implementation in Finance

Only 55% of organizations believe their automation efforts have been successful so far. Measuring the success of an RPA requires focusing on different metrics, depending on how mature the program is.

Early Stages of RPA (Low Maturity)

When starting with RPA, the focus should be on efficiency and productivity. Typical metrics include the number of automated tasks or bots deployed.

However, it’s also essential to consider the impact on employees. Such as how much time is saved on repetitive tasks and whether this has improved employee engagement.

Mid-Level Maturity

As your RPA program grows, you’ll start to see improvements in compliance, such as fewer human errors and the creation of digital audit trails.

At this stage, you should track metrics that reflect these benefits. For example, compare the likelihood and cost of human errors before and after RPA implementation to see how much RPA has reduced errors.

Advanced Maturity

When your RPA program is integrated and scalable across the organization, you’ll see extra benefits. For instance, reusable automation capabilities and cost savings.

Metrics at this stage should include

- the number of reusable RPA solutions,

- the variety of use cases for each capability,

- and the reduction in the number of full-time employees needed for manual tasks.

RPA Use Cases in Finance: Takeaway

Implementing RPA involves more than deploying bots. It requires careful planning, continuous monitoring, and the right metrics to measure success at every stage.

Whether you're starting or scaling your RPA capabilities, checking the right indicators is key to reaping the full benefits of automation.

At Prioxis, we understand the complexities involved in RPA implementation. With over five years of experience and a proven track record of 99% success, we're here to help. We can guide your entire RPA journey—from strategy and planning to deployment and optimization.

Our experienced team can help you achieve tangible results through automation. Let's work together to make your RPA implementation a success.

01How is RPA used in finance?

RPA automates repetitive, high-volume tasks like data entry, report generation, and compliance checks. It speeds up processes, reduces errors, and allows staff to focus on strategic work. Common applications include financial reporting, account reconciliation, and tax reporting, where RPA efficiently handles data extraction, validation, and report generation.

02What are the RPA use cases for banking?

In banking, RPA is used for: Customer Onboarding: Automating verification of customer documents and data entry. Invoice Processing: Reducing manual workload and speeding up invoice handling. Fraud Detection: Monitoring transactions for suspicious activity and generating alerts. Account Reconciliation: Matching transactions across accounts to ensure accuracy. Regulatory Reporting: Automatically generating reports to meet regulatory requirements.

03What is an example of a use case for RPA?

Societe Generale Bank Brazil used RPA to automate reporting processes. This saved employees about six hours of work daily, enabling them to focus on more complex tasks.

04What is RPA in finance?

RPA in finance automates rule-based tasks like data entry, transaction processing, and report generation. It reduces human error and speeds up these time-consuming processes.

05What are the financial benefits of RPA?

RPA in finance offers: Cost Reduction: Saving on processing costs by automating tasks. Increased Efficiency: Performing tasks 24/7 without breaks, speeding up processes. Error Reduction: Minimizing human errors and enhancing data accuracy. Improved Productivity: Freeing employees to focus on higher-value tasks.

06What does RPA mean for banks?

RPA enables banks to streamline operations, enhance customer service, and cut operational costs. It automates routine tasks, improving response times and service efficiency.

07What is RPA in finance and accounting?

RPA in finance and accounting automates tasks like accounts payable, financial reporting, and compliance checks. It helps manage large transaction volumes efficiently, ensuring accuracy and regulatory compliance.

08What is the future of RPA in accounting?

The future of RPA in accounting looks bright, with expected growth in automation adoption. As institutions see the value in RPA, the market is set to expand. Innovations in AI and machine learning will likely enhance RPA, enabling automation of more complex decision-making processes.