Expertise

As a leading provider of insurance automation solutions since 2019, we've partnered with major insurance companies and brokers globally. This article draws from our extensive experience implementing document automation across diverse insurance operations, from regional providers to Fortune 500 carriers. Let's explore how modern automation is transforming insurance operations based on real implementation data and market insights.

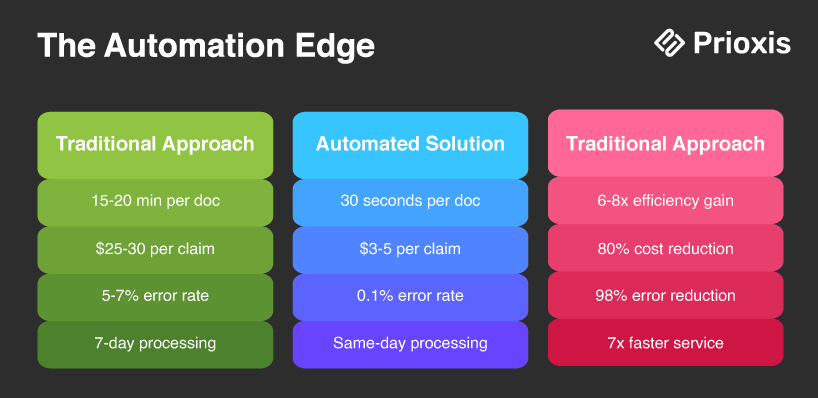

In the highly regulated insurance industry, managing documents accurately and efficiently is key to providing reliable service. Traditional methods are slow, require a lot of manual work, and can lead to mistakes. Using automation for insurance documents makes everything faster, reduces errors, and keeps things compliant with rules. This not only saves time and money but also makes customers happier.

Our industry analysis reveals:

- 77% Prefer to submit claims via mobile

- 65% of insurers lose market share to digital-first competitors

- $2M+ average annual waste in manual processing

- 31% increase in regulatory penalties (2023-2024)

- 40% of staff time spent on document handling

- Majority of insurers are still operating with legacy processes

What is Insurance Document Automation?

Document automation for insurance is a technology-driven approach to create, manage, and store insurance documents without the need for repetitive manual tasks. It uses software to automate steps such as policy generation, claims processing, compliance checks, and document storage. This automation not only reduces time spent on administrative work but also minimizes human error—ensuring more accurate and efficient document handling.

Benefits of Document Automation for Insurance

Intelligent Insurance document automation goes beyond just saving time; it’s a transformative solution for modernizing insurance operations. Here’s how it helps your business stay competitive:

Simplifies Day-to-Day Operations

- Automating repetitive tasks frees up your team to focus on the more critical aspects of insurance work, like building client relationships and making informed decisions.

- Streamlines everything from policy issuance to claims processing, helping you reduce bottlenecks and improve response times.

Reduces Human Error

- Minimizes manual data entry, significantly lowering the chances of errors in policy creation and claims management.

- Reduces the risk of compliance issues due to incorrect or incomplete documentation.

Delivers a Better Client Experience

- Clients appreciate quick responses and easy access to information. Automation helps you provide both speeding up processes and improving service.

- Faster claims processing means happier clients who are more likely to stay with you for the long term.

Keeps You Compliant and Covered

- Automates compliance checks, ensuring all documents meet regulatory standards.

- Reduces the risk of fines and penalties from non-compliance by maintaining accurate records.

Cuts Operational Costs

- Saves costs associated with physical document storage and manual processing.

- Reduces the need for paper, printing, and storage, aligning with sustainable business practices.

Top Document Automation Tools for the Insurance

1. UiPath Document Understanding

UiPath Document Understanding uses robotic process automation (RPA) with machine learning to automatically extract, interpret, and organize data from a variety of documents. This tool can handle complex tasks like data entry for claims, policy management, and other high-volume insurance workflows.

Pros

- Reduces repetitive tasks, freeing up employee time for more valuable work.

- Handles diverse document formats (structured, semi-structured, and unstructured).

- Speeds up data processing and decision-making.

Cons

- Requires initial setup and training for machine learning models.

- May be costly for small businesses due to its robust enterprise capabilities.

Best Suited For

UiPath Document Understanding is ideal for insurers looking for high-speed, high-accuracy data processing. The tool’s RPA and AI integration ensure scalable document management that can grow with the organization.

2. ABBYY

ABBYY is an intelligent document processing (IDP) solution, tailored for capturing and analyzing data from various insurance documents like policies, claims, and endorsements. ABBYY automates data capture, reducing manual intervention and enhancing operational accuracy.

Pros

- Improves decision-making with accurate data capture.

- Supports diverse document types, making it versatile for insurance.

- Enhances customer service by reducing processing times.

Cons

- May have a steep learning curve for teams unfamiliar with IDP.

- Requires occasional model adjustments for document changes.

Best Suited For

ABBYY’s strength is in its detailed data extraction, making it a great fit for insurers who handle various document types and need high-quality, accurate data capture to improve service delivery.

3. Azure AI Document Intelligence (Formerly Azure Form Recognizer)

Microsoft Azure AI Document Intelligence is a cloud-based AI service designed to automate data extraction from documents. It offers prebuilt models for standard documents, as well as custom models for unique insurance forms

Pros

- Efficiently handles large volumes of documents.

- Integrates seamlessly with other Microsoft Azure services, enabling data storage and analysis.

- Reduces manual data entry, improving speed and accuracy.

Cons

- Requires familiarity with Microsoft’s Azure platform.

- May have recurring costs due to its cloud-based pricing model.

Best Suited For

Azure AI Document Intelligence is ideal for companies already invested in Microsoft products in operations like underwriting or claims processing as it integrates smoothly into the Azure ecosystem. It is perfect for insurance companies looking for scalable and customizable document automation with strong cloud support.

4. Adlib Software

Adlib specializes in document transformation, automation, and compliance. It helps insurers efficiently process, convert, and manage high volumes of documents, making it particularly valuable for companies with stringent regulatory requirements.

Pros

- Strong compliance capabilities, supporting regulatory standards.

- Streamlines document workflows and reduces operational costs.

- Centralizes document handling for easy access and tracking.

Cons

- Primarily focused on document transformation, so it may need integrations for broader automation.

- Best suited for larger enterprises due to its advanced compliance features.

Best Suited For

Adlib is perfect for insurance companies focused on regulatory compliance and operational efficiency. Its powerful document transformation capabilities ensure consistent data handling, ideal for industries requiring strict adherence to compliance.

5. PandaDoc

PandaDoc is a document automation tool offering customizable templates, e-signature integration, and a streamlined document workflow. It’s particularly useful for insurers needing a simple way to create and sign documents like policies and claims forms.

Pros

- Offers built-in e-signature and workflow management for easy handling.

- Simplifies document creation with reusable templates.

- Facilitates quick document approvals and processing.

Cons

- Limited advanced automation capabilities compared to dedicated RPA tools.

- May not be ideal for large-scale data extraction needs.

Best Suited For

PandaDoc is a great choice for insurance companies looking for straightforward document workflows and signature management. It’s best suited for teams needing a user-friendly tool that enhances document handling without the complexity of advanced automation.

6. HotDocs

HotDocs is a widely trusted tool for automating the creation of complex, compliance-driven documents like insurance policies, claims, and contracts. By standardizing document creation, it improves accuracy and consistency, especially in regulated industries.

Pros

- Ensures compliance with detailed, template-based document creation.

- Reduces errors and saves time with standardized formats.

- Trusted by various industries for handling complex documentation.

Cons

- Limited capabilities for real-time document updates and data extraction.

- Primarily useful for document generation, so it may require additional tools for end-to-end automation.

Best Suited For

HotDocs is perfect for insurance companies focused on generating complex, compliant documents efficiently. Its specialization in document standardization makes it highly reliable for policy and claims generation.

7. Automation Anywhere’s AARI

AARI from Automation Anywhere is a digital assistant that streamlines front-office and back-office tasks, making document processing and customer service faster and easier. It combines RPA with AI to handle repetitive tasks like claims intake, policy updates, and underwriting.

Pros

- Scales automation across departments with a digital assistant.

- Reduces manual work and increases speed in document-heavy processes.

- Enhances collaboration between departments with easy task sharing.

Cons

- Best suited for larger organizations with complex document workflows.

- Initial setup and integration can require time and resources.

Best Suited For

Automation Anywhere’s AARI offers a versatile, AI-driven assistant that helps insurance companies streamline workflows across departments. It’s ideal for insurers looking to improve efficiency in both customer-facing and internal operations.

Read Further: Business Intelligence in Insurance

Best Practices for Implementing Insurance Document Automation

Adopting document automation requires careful planning to maximize its benefits. Here are some best practices to guide a smooth and effective implementation:

1. Identify Your High-Impact Processes

Begin by focusing on processes that provide the most significant time and cost savings, like claims processing and policy issuance. By automating workflows with high volumes of repetitive tasks, you’ll see a quicker return on investment and measurable efficiency improvements.

Tip: Prioritize processes with repetitive, time-consuming tasks to achieve the fastest ROI and create a foundation for broader automation in the future.

2. Choose the Right Automation Software

Select automation software that integrates easily with your existing systems, such as customer relationship management (CRM) or policy administration tools. A platform that’s user-friendly and intuitive will require minimal training, making the transition smoother for your team.

Tip: Look for software that offers flexible integration options and a straightforward user interface to minimize the learning curve and accelerate implementation.

3. Compliance with Data Security Standards

Insurance data is sensitive and highly regulated. Choose automation solutions that adhere to industry security standards, protecting your data and ensuring compliance with data protection laws. Establish a schedule for regularly updating security protocols to safeguard against data breaches and maintain client trust.

Tip: Verify that the platform supports encryption, multi-factor authentication, and other security measures relevant to insurance data.

4. Establish Clear Guidelines and Training

To maximize effectiveness, provide thorough training for your team on using the new automation tools. Develop clear guidelines for handling and managing automated documents to ensure that everyone follows consistent practices, maintaining document quality and compliance.

Tip: Set up training sessions and create a quick-reference guide to help team members get comfortable with the automation processes.

5. Monitor and Optimize for Continuous Improvement

Document automation is a continuous - evolving process. Regularly track performance metrics like processing time and error rates to pinpoint areas needing improvement. Encourage team feedback to continually refine automated processes, adapt to new challenges and optimize efficiency.

Tip: Set periodic review checkpoints and stay open to team suggestions for incremental improvements, fostering a culture of continuous optimization.

With these best practices, implementing document automation becomes straightforward, enabling your team to create, process, and securely store complex documents with ease. By adopting the right strategies and tools, insurance companies can make document management more efficient, consistent, and secure, ultimately enhancing client satisfaction and business growth.

Conclusion

Finding the right tools for your insurance automation can be challenging. At Prioxis, we help companies choose the best RPA and AI solutions to automate insurance processes. These automation tools make it easy to create, fill, route, and securely store documents, no matter how complex. Let’s talk about your needs and see how we can make managing your insurance documents simpler and more efficient.