Expertise

Peer-to-peer lending, which goes directly to consumers and away from traditional banks, is changing the face of funding and investment for the rapidly developing fintech sector. The fintech market, therefore, will grow to a whopping $1506.24 billion by 2031, offering an avenue for new, innovative P2P lending applications.

P2P lending platforms need more than high-tech features to be effective. Encouraging user trust necessitates user-centric design, robust security, advanced functionality, and rigorous regulatory compliance.

We shall explain the necessary procedures and approaches for creating peer-to-peer lending applications that function well in this blog. Dive in and get ready to transform your idea into a revolutionary P2P lending loan solution.

What is a P2P Lending App?

A peer-to-peer (P2P) lending platform is a digital solution that connects borrowers with lenders, eliminating the need for traditional bank involvement. This model allows borrowers to access funds quickly while enabling lenders to earn attractive returns on their deposits.

Here's how it works:

- Lenders create an account and deposit funds to be used for loans.

- Once activated, the borrower's profile is assessed regarding creditworthiness, which assigns the borrower a category of risk and the interest to be charged to them.

After the P2P Loan App offers are made, borrowers choose that best suits their necessities. The P2P Loan Platform then manages key operations like disbursing the loan amounts and collecting monthly repayments for smooth financial transaction processes.

Traditional Banks VS Lending Platforms

| Criteria | Traditional Bank | P2P Platform |

|---|---|---|

| Intermediary | Acts as an intermediary between borrowers and lenders | Directly connects borrowers and lenders |

| Interest Rates | Typically higher for borrowers and lower returns for investors | Generally lower for borrowers and higher returns for investors |

| Loan Sizes | Often have higher minimum loan amounts | Lower minimum loan amounts, offering more flexibility |

| Speed of Funding | Can take longer to approve and disburse loans | Faster approval and disbursement of loans |

| Risk Assessment | Relies on credit scores and collateral | Uses alternative data sources and innovative risk assessment models |

| Regulatory Oversight | Heavily regulated by government authorities | Regulations vary by jurisdiction and may not be as stringent |

| Customer Experience | Often less personalized and more bureaucratic | More personalized and user-friendly experience |

| Accessibility | May have stricter eligibility requirements and limited accessibility | Generally more accessible and inclusive |

How Does A P2P Lending App Work?

Peer-to-peer lending apps work on two different panels: one for borrowers and one for lenders. It is essential to know how each process works, whether you are looking for funds or to invest. Here's how it works:

For Borrowers

Sign-Up

Start by registering on the lending app. Fill in all the details, including your personal information and bank details.

Profile Verification

Once registered, your profile undergoes a verification process. This step updates your information on the platform, allowing lenders to assess the risks and rewards of lending to you.

Loan Market

After approval, your loan request goes live on the app's marketplace. Lenders then start bidding on your loan, offering their funds.

Loan Acceptance

Whenever you get a loan request fully funded (100% of the required amount is acquired), you may review and agree to the conditions provided. At this point, there is an applied minimal transaction fee.

Repayment

After this, your repayment schedule shall be shown; you will find fixed monthly installments that have to be done until the whole loan is covered.

For Lenders

Registration

You become a lender when you sign up on the application for the website, and through it, you begin to have investment opportunities.

Account Selection

Select the type of Peer-2-Peer Lending account that aligns with your investment objectives - either growth, income, or self-select options.

Add Funds

Deposit funds into your selected account using any available payment method, which puts you in a position to bid on loans.

Lend Money

Look for live loan requests and place bids on those whose terms are appealing to your investment preferences. Your funds are then channeled to the borrowers who share your risk preferences.

Repayment

You will get monthly repayments that include your principal and the interest earned. You can opt to reinvest these repayments in new loan opportunities to maximize your returns.

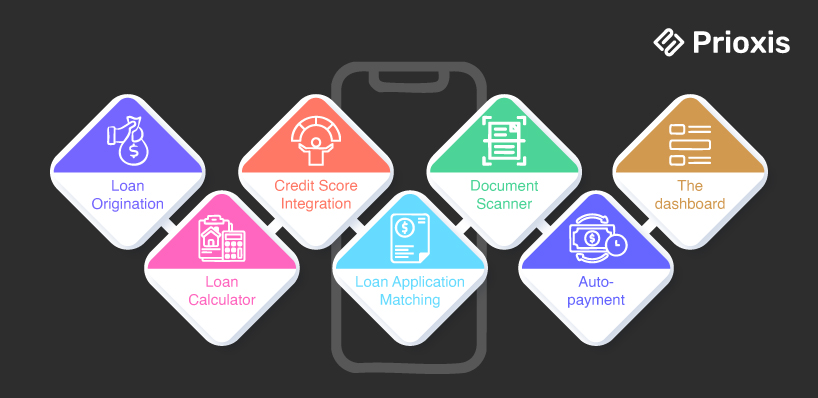

P2P Lending Platform Key Features

A P2P lending platform is successful if its functionality and silky smooth user experience are maintained. From the origin of a loan to more detailed analytics, there's a need for proper features to meet the requirements of borrowers, investors, and administrators at the platform level. Here is a breakdown of must-have features:

For Borrowers

Loan Origination

A smooth application process ensures that borrowers can make easy loan applications, and lenders can swiftly analyze the risks and rewards concerning every application. That is the skeleton of any P2P lending site.

Loan Calculator

An integrated loan calculator simplifies the process by enabling borrowers to estimate payments and interest rates based on various terms. Offering multiple calculation options—such as on the home screen and a dedicated page—ensures clarity and convenience.

Credit Score Integration

By incorporating credit score data during onboarding or the loan application process, the platform provides an accurate assessment of a borrower’s creditworthiness, which is critical for determining loan eligibility and setting interest rates.

Loan Application Matching

An automatic matching system pairs borrower applications with investor preferences, enhancing the efficiency and speed of securing loans.

Document Scanner

A built-in document scanner increases the ease of uploading necessary documents and files to a borrower, reducing manual labor and speeding up the verification process for a borrower's loan.

Auto-payment

Allows borrowers to pre-set automatic repaying, preventing any default behavior. It would also give such borrowers an incentive of a lower rate of interest to repay the installments regularly in the future for loans.

The Dashboard

A complete dashboard will give the borrower live insights into their loan status, outstanding balances, repayment schedules, and transaction history, thus bringing transparency and control throughout the lifecycle of the loan.

For Investors

Loan Portfolio Management

Through a dedicated dashboard, investors can track their investments with details regarding loans, performance metrics, and returns. It also allows investors to diversify their investments and automatically reinvest returns.

Loans Search

Advanced filtering capabilities can help investors look for loans using various parameters like amount, interest rate, credit score, and loan purpose for diversification in investment portfolios.

Semi-Automated Investment

Investors would have the ability to look for loans by various filters including loan amount, interest rate, credit score, and loan purpose to construct diversified and balanced portfolios.

Semi-Automated Investment

Setting up personalized investment criteria, including preferred loan amounts and risk levels, allows the platform to suggest or invest in loans that meet the investor's strategies, thereby saving time and effort.

For Platform Administrators

User Management

Robust user management tools ensure access, allowing administrators to create, modify, or delete accounts, assign roles, and monitor activity on sensitive financial data.

Customer Relationship Management (CRM)

An all-in-one CRM system equips the administrator with information related to user behavior, manages communication, and is effective at improving the overall user experience.

Loan Management

Administrators hold complete control of the loan cycle, including creating customized loan terms, managing interest rates, and monitoring both the borrower and the lender's information.

Finance Management

This feature tracks all financial activities—such as disbursements, repayments, and service fees—ensuring transparency and accurate financial reporting.

Platform Analytics

Customizable dashboards display key performance indicators and other vital metrics, allowing administrators to monitor platform health, identify trends, and make data-driven decisions.

Benefits of P2P Lending

Peer-to-peer lending sites offer great benefits to both borrowers and lenders.

For Borrowers

- Few Intermediaries: Borrowers and lenders are directly connected, thus reducing fees and making the process easier.

- More Flexibility: You can negotiate favorable terms without collateral because you have access to a wide network of lenders.

- Rigorous Credit Checks: Detailed assessments ensure transparency and build trust between both parties.

For Lenders/Investors

- Higher ROI: P2P lending often offers better returns compared to traditional investments.

- Robust Fraud Prevention: Advanced risk assessment systems and strict policies help protect your investment.

- Portfolio Diversification: Spread your investment across various loans to reduce risk and add profit opportunities.

P2P Lending App Development Process

The process of developing a solid P2P lending app begins with strategic steps to ensure security, usability, and compliance with the platform. Here's the process in general:

- Market Analysis & Niche Identification

Conduct in-depth market research about the competitive landscape and pinpoint the niche opportunities. Identify your target audience, understand their needs, and then define how your platform can outdo others in this burgeoning P2P lending marketplace.

- Regulatory Compliance and Security Planning

Financial platforms are subject to strict regulations, and data security would be a top priority. Set up an all-encompassing plan to address the needs of regulatory compliance and ensure strong security features for user data, thereby establishing confidence and trust right from the beginning.

- Choose the Right Business Model

Determine a business model that is in line with your strategic objectives. Choose either a revenue sharing, subscription fees model, or other models applicable to your intent of sustainable growth coupled with meeting the needs of borrowers and lenders.

- UX/UI Design

Create a user-centric interface that should be intuitive and interesting. Ensure a seamless experience for both borrowers and lenders, communicating simplicity, ease of navigation, and accessibility.

- MVP Development

Develop your Minimum Viable Product, featuring the core characteristics of your peer-to-peer lending platform. Your MVP is ready to be piloted, ensuring you test those fundamental functionalities to get early user feedback and adapt the app appropriately before its proper launch.

- Testing Your Peer-to-Peer Lending App

Conduct extensive testing to ensure your app performs reliably and securely. This includes functionality testing, security audits, performance testing, and user acceptance testing, ensuring the final product meets all quality standards and user expectations.

How Much Does P2P Lending App Development Cost?

The cost to develop a P2P lending app varies largely depending on:

- Complexity & Features

This depends on how complex your solution is and how many features it has, ranging from loan origination to document scanning and everything in between.

- Tech Stack & Development Hours

The development of a reliable P2P lending platform usually takes approximately 2,200 hours of development time. Its cost typically ranges from about $100,000.

- Development Timeframe

Developing a complete peer-to-peer lending platform takes anywhere between six months and one year. Choosing white-label solutions can significantly decrease the time spent on development as well as budget—by sometimes two to three times.

- Ongoing Maintenance

Beyond initial development, ongoing costs include server hosting, security updates, and regulatory compliance. The running cost will be from a few thousand dollars to close to $10,000 depending on the size and complexity of the platform.

All in all, even though the upfront investment might be enormous, you could always plan such that you are observing budgets and leveraging existing solutions to add speed to your time to market.

Final Words

With high demand from its easy access and attractive low interest rates, peer-to-peer lending apps have attracted the world's attention. Here at Prioxis, we will assist you in finding a customized outsourcing strategy that fits into your in-house team or complements your overall IT capabilities as a standalone service. Let Prioxis turn your vision into a P2P lending platform that flourishes with today's changing needs.