Expertise

The process of the origination of loans has always been a long and cumbersome exercise full of errors. But in the current age of fast-paced digitalization, lenders cannot live without new-age automation. This alone revolutionizes the sector so that the speed and accuracy of processing loans become unbelievably effective.

Loan automation facilitates a financial institution to cut down on costs, boost compliance, enhance customer experience, and scale up to living up to an increase in demand automatically. If your organization is still tied down by paper-based workflows, maybe it's time for a change. Automating your loan origination process is the secret to staying ahead in a highly competitive marketplace.

What Is Loan Origination Automation?

Loan origination automation involves leveraging digital technology to bring efficiency and value to the loan approval process- from application to disbursement. This encompasses all tasks such as borrower screening, document verification, underwriting, and final approval.

Automated Loan Processing Systems have displaced checks and paperwork with smart software to enable:

- Fast processing of applications

- Accurate verification of documents

- Minimization of human errors

- Reduction of operational costs

- Improvement of customer experience

By automating these processes, lenders can approve loans faster, remain compliant with regulations, and maintain market position in the ever-changing digital lending environment.

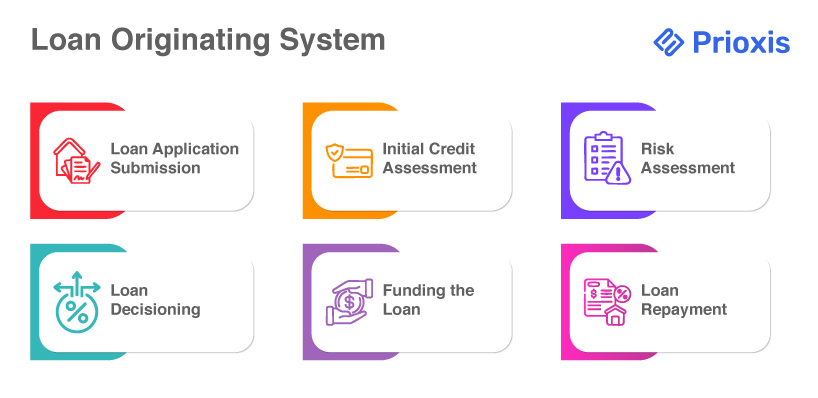

How Does the Loan Origination Process Work?

The whole process of originations stands as one of the most crucial parts of lending because here lies the determination regarding borrower eligibility and determination of terms for the loan. The succession of events leads to compliance, risk mitigation, and enriched customer experience.

The following is a description of this process:

- Loan Application Submission – The first step involves a borrower submitting a loan inquiry or application online or by way of the lender's platform.

- Initial Credit Assessment – The lender verifies necessary documents like proof of identity, address, income statement, and bank statement.

- Risk Assessment – The creditworthiness and risk level of the loans are assessed by automated decision engines based on an applicant's financial history and other key factors.

- Loan Decisioning – The lender forms an individualized loan offer, with the amount and interest as well as repayment terms, based on risk analysis.

- Funding the Loan – The funds are then disbursed into the borrower's account from the lender's funds once the borrower has accepted the terms.

- Loan Repayment – After that, the borrower repays the loan in scheduled installments according to an agreed repayment program.

It takes time and effort for such processes, which is where automation plays to the fore, speeding up approval while increasing accuracy and customer experience.

Key Advantages of Loan Origination Automation

Here are the very important pros of automating the process of loan origination:

1. Increased Efficiency

The loan origination process consists of several activities covering the flow of application processing to fund disbursement. It eliminates manual data entry, fastens approvals and soaks up a seamless workflow in its processes. Thus, more loan applications are processed by lenders within a shorter time, generating income opportunities and customer satisfaction.

2. Enhanced Customer Experience

Today, a consumer expects a much quicker, more transparent, and personalized application for loans. Such automated systems can use customer information to bring personalized loan and repayment options for customers. Status updates, alongside real-time tracking, also add to their transparency, giving higher chances of customer retention and referrals.

3. Compliance and Risk Management

Financial institutions conduct operations in a very regulated environment, which comes with strict compliance requirements. Automation serves as a means for the organization to comply with the industry's standard regulations such as Basel III, GDPR, and Payment Services Directives. Such reporting enhances automation within audit trails, thus ensuring compliance to reduce risk, as well as penalties incurred through noncompliance.

4. End-to-End Visibility

It's quite difficult due to having many touchpoints in the loan origination process. The automation platform offers real-time tracking because all stakeholders, including account managers or underwriters, should be able to view the application progress that watershed visibility brings to the decision-making process, cuts the time to approve applications, and helps streamline workflows.

5. Seamless System Linking

Most legacy systems in financial institutions prevent new technologies from being integrated. Automation platforms are orchestration layers that interconnect the different systems of a bank to ensure data exchange. Connects banks, for example, with APIs and app connectors for seamless communication in real time between mortgages internalization, credit lines, and personal loans into improved operational transparency.

6. Fast Approvals

With automated systems, it only takes a minute to analyze the data belonging to the applicant against basic credit, debt, and income characteristics. That will speed up the approval process, improve borrower satisfaction, and increase loan conversion rates.

7. Few Mistakes

Manual entry increases the chance for mistakes to occur, such as wrong borrower details or missing documents. Automated processes eliminate most of these mistakes in the accurate and consistent processing of loans, which in turn diminishes rework time and resources.

8. Lowered Operational Costs

Extensive manual labor gets taken out by the automated systems, thus, operational expenses decrease. Financial institutions can optimize the allocation of human resources on strategic decision-making rather than routine, repetitive work that is mostly administrative.

9. Better Risk Assessment

Through analytics driven by AI, automated systems can often recognize the red flags that usually escape bank reviewers' eyes. This is a preventive measure against risk that minimizes defaults in loans as well as ensures a healthier loan scattering among borrowers.

10. Increased Revenue Generation

Given increased loan processing opportunities, processes such as approving loans could thus require lesser time. This puts to use the scalability of the system allowing more revenue generation for the company while improving its operational efficiency.

11. Enhanced Employee Productivities

Employees will thus be free to engage in other high-value tasks like customer relationship management, loan structuring, and strategic planning. This is an admirable way to increase productivity and job satisfaction while simultaneously providing better services.

12. Data-Driven Decision Making

The automation platform generates a lot of insights through its analytics and reporting tools. Lenders can put to use data-driven intelligence to highlight bottlenecks, optimize loan products, and fine-tune underwriting strategies for maximum profitability.

13. Competitive Advantage

Those financial institutions that have automated gain a strong competitive advantage. With fast loan processing services that are seamless and free from error, they will win customers, build their brand reputation, and always be ahead of the competition.

Conclusion

Automated Loan Processing is reshaping the lending industry; it ensures process optimization and a better borrower experience. In an environment where AI automation speeds up loan approval, adds to accuracy, and facilitates the personalization of lending solutions, manual intervention is minimized to make risk assessments with the greatest amount of data. This process, in turn, assists lenders in making the right decisions, keeping compliance, and ensuring operational efficiency.

Prioxis Digital Lending Automation is an advanced technology to optimize and fully automate the loan origination process. From risk assessment through pricing strategies and product recommendation, Prioxis allows all of these to scale business lending efficiently. With intelligent automation inputs, lenders will optimize customer journeys and ensure their growth in a fast-paced, competitive landscape.