AI in Portfolio Management: How AI is Reshaping Investing

Admin

Admin AI

AI Nov 29, 2024

Nov 29, 2024

Table of Content

People in finance have always been intrigued and fascinated by the idea of using AI and machine learning (ML) in investment strategies. Renaissance Technologies, founded by late Jim Simons, was a pioneer in applying AI to finance, and the returns generated by its funds became the talk of Wall Street, as they outperformed the market many times.

Managing investments has always been a balancing act. Markets can be unpredictable, and traditional strategies often fall short. If you’re an investor, financial advisor, or part of an asset management team, you’ve probably faced the challenges of juggling risk, return, and time. You’re dealing with huge amounts of data, complex market trends, and the pressure to make the right calls quickly.

AI takes the guesswork out of managing investments and brings a level of precision and speed that wasn’t possible before.

In this post, you’ll learn how AI is reshaping portfolio management. We’ll dive into how it works, its real-world applications, and the benefits it brings to the table.

How is AI Revolutionizing Asset Management?

Managing investments is challenging, isn’t it? Whether you're an individual investor, a financial advisor, or part of an asset management firm, balancing risk and returns is like walking a tightrope. Markets are constantly shifting, data is coming in from all directions, and emotions can cloud judgment especially in unpredictable environments. It’s exhausting, and if we’re being honest, the stakes are just too high for guesswork.

This is where Artificial Intelligence (AI) steps in. AI removes guesswork and emotion from the decision-making process. AI can analyze endless streams of data, spot subtle trends, and even make projections—all in real-time. It’s not here to replace humans but to work alongside us, providing insights we couldn’t uncover on our own. By automating processes and drawing meaningful conclusions from large datasets, AI offers a new way to navigate the complex financial world. AI enables humans to expand their horizons, allowing them to trade in several other global markets.

In this post, we’ll explore how AI is revolutionizing portfolio management, making it more efficient, accurate, and accessible.

What is Portfolio Management?

Active portfolio management often works like a zero-sum game; when one person makes a profit, someone else takes a loss. That’s why investors are constantly trying to stay on the winning side. At its core, portfolio management is about choosing the right mix of assets(stocks, bonds, real estate, commodities) and balancing them in a way that aims to boost returns while keeping risk under control.

It sounds simple, but the reality is anything but. Financial markets are delicate, and even minor disruptions can lead to substantial losses. Add in economic uncertainty, unexpected events like pandemics, new regulations, and the complexity of different asset classes, and things get complicated quickly. Emotions don’t make it easier either; fear, overconfidence, and anxiety can turn reasonable decisions into risky ones.

Traditional portfolio management is resource-heavy. It relies on manual data analysis, extensive research, and human intuition. And while that expertise is incredibly valuable, humans are, well, human. We make mistakes, miss things, and let biases influence decisions.

AI brings something different to the table—a consistent, data-driven approach. It can process vast amounts of information much faster than any human could and detect patterns that aren’t always visible to the human eye. In fact, with markets generating about 2.5 quintillion bytes of data every day, expecting people to handle all that complexity manually is simply unrealistic. AI makes the impossible possible by turning mountains of data into clear, actionable insights.

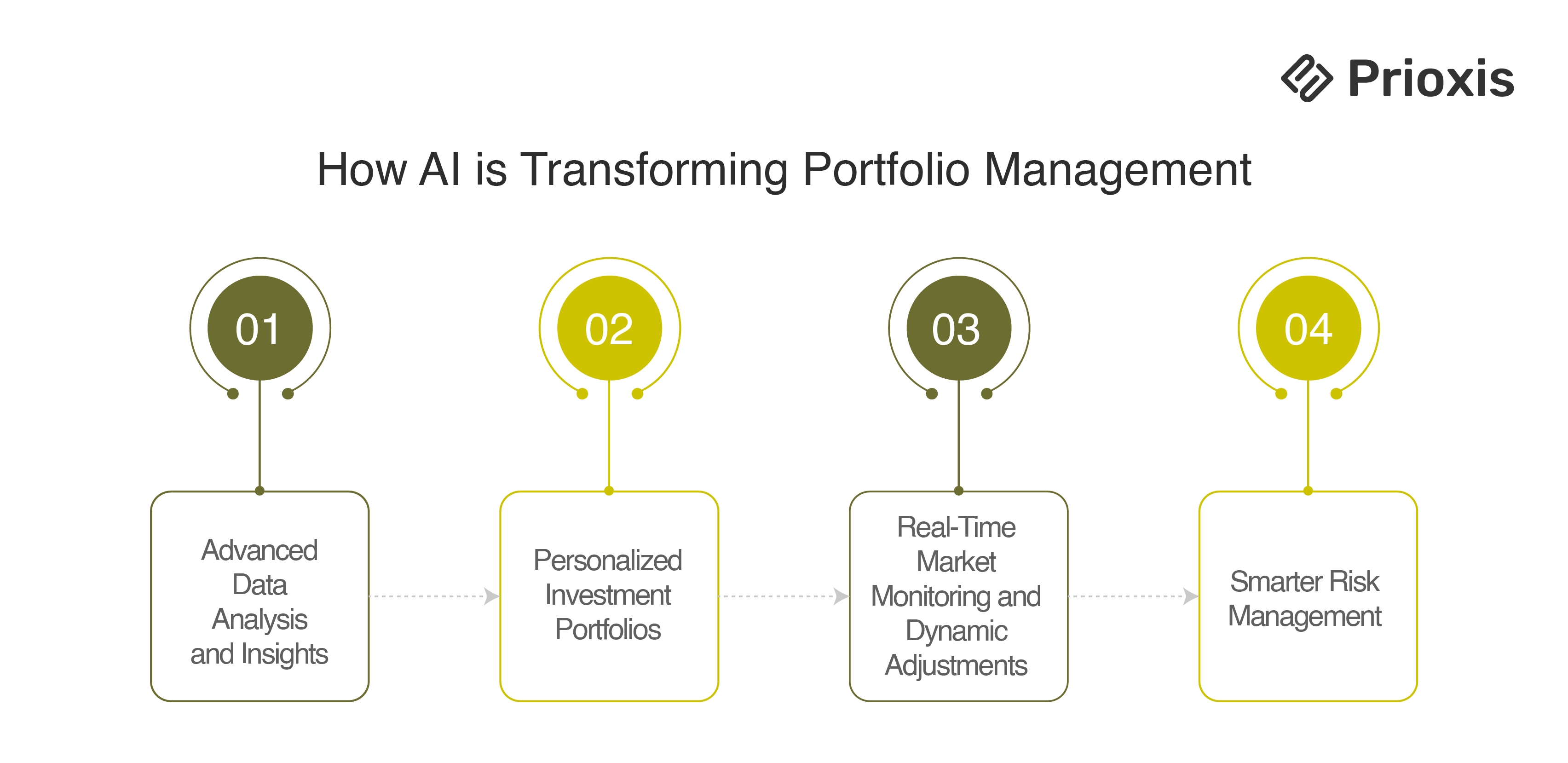

How AI is Transforming Portfolio Management?

1. Advanced Data Analysis and Insights

Data analysis is a task that can be performed more efficiently and effectively by AI than by humans.

We’re talking about massive datasets, spanning years of market activity, economic indicators, corporate earnings, news, social media trends, and even global weather events. AI can process all of this data, much of it unstructured, in real time and then draw connections that we wouldn’t notice.

Take natural language processing (NLP), for example. AI uses NLP to scan news headlines, earnings reports, and tweets to gauge sentiment. If a CEO makes a promising announcement or a country’s economic outlook suddenly darkens, AI can interpret that and provide real-time recommendations. Investors can then act, not after a deep-dive analysis that takes days, but in a matter of moments.

According to PwC, leveraging AI for data analysis can reduce the time required for financial analysis by up to 60%. Imagine gaining an edge by having vital insights delivered before your competitors can even finish their first cup of coffee. It changes the game entirely.

2. Personalized Investment Portfolios

AI isn't just about crunching numbers and processing data; it’s also about making investments more personal. Every investor has different financial goals, risk tolerance, and timelines. AI allows for hyper-personalization of investment strategies. By analyzing an individual’s preferences, historical behaviors, and market trends, AI can build a tailored portfolio designed specifically for that person.

In the past, personalized investment advice was something only the ultra-wealthy could afford. Now, robo-advisors like Betterment and Wealthfront offer AI-driven investment solutions that are affordable for everyday investors. They assess your goals and automatically adjust the strategy based on market shifts. According to research, AI-powered portfolios can yield 20-30% better performance, partly due to AI’s ability to react more swiftly to changing market conditions and eliminate emotional biases.

3. Real-Time Market Monitoring and Dynamic Adjustments

24/7 monitoring of global markets is something that AI does effortlessly, which is a major boon. Unlike traditional systems that work on set schedules, AI does not sleep. It is always scanning, analyzing, and assessing market data, news reports, and even social sentiment to adjust portfolios in real time.

Consider BlackRock’s Aladdin, an AI-driven asset management tool that manages over $21 trillion in assets. Aladdin continuously monitors all aspects of the portfolio—from market movements to individual asset performance—helping portfolio managers get insights faster and act before it’s too late. Aladdin’s integration of AI has resulted in 20% fewer investment losses during times of heightened market volatility compared to traditional systems, simply by providing earlier and more accurate warnings.

The ability to react dynamically means that AI-driven portfolios can adapt to minimize losses when the market turns south or to seize an opportunity when conditions are right. It’s like having a vigilant co-pilot who’s always on watch, keeping an eye out for turbulence.

4. Smarter Risk Management

Risk is inevitable when investing. It can’t be eliminated, but it can be managed intelligently, and this is where AI helps.

AI takes a multi-faceted approach to risk management. It evaluates credit risk, liquidity risk, market risk, and operational risk by processing historical data, monitoring current market conditions, and simulating future scenarios.

- Credit Risk AI systems analyze borrower histories, market conditions, and economic factors to assess creditworthiness. This minimizes bad loans and investment losses.

- Liquidity Risk AI forecasts liquidity by predicting how quickly an asset can be sold without significantly impacting its price. This helps investors avoid situations where they can’t offload assets when needed.

- Market Risk AI uses predictive modeling to assess market conditions. For instance, machine learning models can simulate the impact of changes in interest rates or commodity prices on a portfolio, allowing managers to adjust asset allocations proactively.

According to Accenture, 84% of financial institutions already use AI for some level of risk assessment, and those using AI-driven risk mitigation strategies have reduced losses by 40% compared to those who still rely purely on traditional analysis.

Real-World Applications: AI in Action

1. ESG Investing

Environmental, Social, and Governance (ESG) investing is becoming increasingly important to investors who care not just about profits, but also about sustainability and ethical practices. AI helps make ESG investing more effective by analyzing vast quantities of data to evaluate a company's social impact, governance, and sustainability efforts.

For instance, AI can analyze corporate statements, assess greenhouse gas emissions data, monitor labor practices, and even gauge the sentiment of news coverage about a company. According to a study from McKinsey, ESG-focused companies tend to exhibit 30-50% less volatility compared to their non-ESG counterparts, and AI ensures that ESG portfolios are data-driven and rigorous, helping investors align their portfolios with both their values and financial goals.

2. Dynamic Asset Allocation

Asset allocation—how you distribute investments across asset classes like stocks, bonds, and real estate—is crucial for balancing risk and return. AI takes asset allocation to the next level by dynamically adjusting it in response to real-time market signals and investor behavior.

If AI detects that market volatility is on the rise, it might move funds into safer investments like government bonds or gold. Alternatively, if market confidence is growing, it could allocate more towards equities to capture the upside. Goldman Sachs has reported that AI-driven rebalancing strategies have reduced the impact of market downturns by 30% compared to traditional, periodic rebalancing.

3. Predictive Analytics for Market Trends

Predictive analytics is one of AI’s strongest suits. It uses historical data to forecast future market trends, allowing investors to be proactive rather than reactive. Imagine an AI model that predicts an impending market downturn in the tech sector—investors can then reduce their exposure, mitigating risk before losses occur.

According to a survey by McKinsey, 60% of investment firms using AI for predictive analytics reported more consistent returns. AI's ability to anticipate changes provides a strategic advantage in a world where getting ahead of the trend often makes all the difference.

4. Fraud Detection

Fraud is an unfortunate reality in the financial world, costing institutions billions annually. AI helps combat this by recognizing unusual patterns and behaviors in transaction data that might indicate fraud.

HSBC, for example, uses AI to monitor over 600 million transactions annually. The bank’s AI system uses machine learning to spot anomalies in transaction data that might signal fraudulent behavior—like repeated transactions of unusual amounts or activity originating from suspicious locations. This kind of continuous oversight has reduced fraud detection times by 60%.

AI in Portfolio Management: Weighing the Benefits

1. Greater Efficiency

AI can process financial data at a speed 10 times faster than traditional methods. By automating repetitive tasks like portfolio rebalancing, risk analysis, and compliance checks, AI frees up human managers to focus on more strategic aspects of investing. Imagine if your portfolio manager could focus less on admin work and more on finding new investment opportunities—that’s the kind of value AI provides.

2. Improved Accuracy and Less Bias

Human decision-making is vulnerable to biases. Whether it’s confirmation bias (where we focus on information that supports what we already believe) or herding bias (where we follow what everyone else is doing), these influences can lead to poor investment choices. AI doesn’t have these flaws. It uses data objectively to make decisions, which can lead to fewer mistakes and better accuracy. A report by Deloitte found that AI-driven portfolios make 25% fewer errors than those managed without AI.

3. Cost Reduction

AI is making professional-level investment management accessible to everyone. Traditionally, high-level portfolio management required hefty fees paid to advisors. AI is making it more affordable, and according to a study by Vanguard, AI-driven portfolios cost investors 40-50% less than portfolios managed by human advisors alone. This cost reduction is leading to greater inclusivity in investing, allowing even smaller investors to benefit from sophisticated strategies.

4. 24/7 Adaptability

Markets don’t sleep, and neither does AI. When news breaks in the middle of the night, it’s AI that reacts, providing updated insights and adjusting as needed. Imagine a sudden announcement impacting international trade—AI can assess the implications across multiple markets, enabling real-time strategy shifts without waiting for the next day. This adaptability is invaluable, especially in an era of globalized markets where news moves faster than ever.

5. Increased Transparency

One common criticism of AI is that it’s a “black box,” where the decision-making process isn’t always clear. However, the development of Explainable AI (XAI) is addressing that. XAI aims to make AI models more interpretable so that humans can understand why certain recommendations or decisions were made. This fosters greater transparency, which builds trust between AI systems and their users. Trust is essential in financial matters, and the industry is working hard to ensure that AI tools meet the transparency standards expected by investors.

Ethical Considerations of AI in Portfolio Management

While AI has its strengths, there are valid ethical concerns that we must consider.

1. Bias and Fairness

The data used to train AI systems isn’t perfect. If biased data is fed into the system, the output will also be biased. For instance, if AI systems are trained with data that underrepresents certain sectors or geographic regions, the investment recommendations could reflect that imbalance. Bias in AI-driven financial products could unintentionally result in unequal access to opportunities. Regular audits and stringent training processes are essential to mitigate this risk.

2. Data Privacy

AI relies on analyzing sensitive data—financial histories, personal preferences, transactional data—all of which require utmost security. Ensuring compliance with privacy regulations like GDPR is critical. When individuals share their data for AI-based investment advice, they must trust that this information is being protected and used responsibly.

3. Accountability and Trust

Who is responsible when an AI-driven investment doesn’t go as planned? Unlike traditional systems, where decisions can be traced back to a manager, AI’s decision-making processes are more complex. Without human judgment involved at every level, there’s a concern over accountability. Regulators are currently working on defining clearer frameworks to ensure investors are adequately protected.

4. Market Manipulation and Systemic Risk

AI is powerful, but with great power comes great responsibility. If too many market participants use similar AI-driven strategies, it could amplify market movements, create herding behavior, or even increase systemic risk during downturns. Striking the right balance between innovation and regulation is key to ensuring long-term market stability.

What’s Next for AI in Portfolio Management?

AI in portfolio management is still evolving, but its trajectory is clear: it’s here to stay. The future will likely include advancements like:

- Explainable AI (XAI) Models make their decision-making processes easier to understand, fostering greater trust.

- Deeper ESG Insights AI systems will become even better at analyzing the environmental, social, and governance aspects of companies.

- Enhanced Personalization Portfolios will be even more tailored to individual needs as AI gets better at understanding human behaviors and financial goals.

- Stronger Regulatory Oversight Governments and financial authorities will likely create clearer guidelines to ensure ethical AI use in the industry.

Final Thoughts

AI has opened a world of possibilities for portfolio management. From smarter data analysis to risk mitigation and tailored investment strategies, it offers tools that were unimaginable just a decade ago. While there are challenges—ethical concerns, transparency issues, and data security risks—the potential benefits are too significant to ignore.

For investors, asset managers, and financial institutions, AI isn’t just a trend. It’s a transformative force that’s leveling the playing field and making portfolio management more efficient, accurate, and accessible than ever.

The world of investing is changing, and AI is at the forefront of this evolution. Whether you're just starting or managing complex portfolios, embracing this technology can be a game-changer for your financial journey. If you want to implement AI in your business operations, we can help. With 5+ years of experience in AI technologies, our developers can create a customized AI solutions as per your business needs.

Get in touch